ST Global Health Newsletter

Hello and welcome to the second installment of the ST Global Health Fund newsletter. Our goal in our semi-regular newsletters is to provide context and musings on the overall markets, the healthcare sector, small caps, and on some interesting companies. If you are interested in setting up a meeting with our team, please feel free to reach out.

In our previous newsletter we explored the rebound of small cap healthcare after notable market downturns with special focus on the 2008-2009 downturn. We ultimately found that being invested in healthcare prior to the lowest point of the market would have generally led to greater outperformance compared to joining at the bottom (i.e. healthcare starts to rise sooner than the rest of the market). The findings led us to dig deeper to understand specific companies and their pathology, and to determine how the market downturn and recovery affected them. We focused our search on companies that were small, had solid fundamentals, that were deploying disruptive innovation in healthcare, and that ranked highly according to a proprietary factor model. The combination leads to companies that may be underappreciated for a number of reasons, and this difference becomes more accentuated during a downturn. Below are a couple of examples from the Great Recession.

Exact Sciences

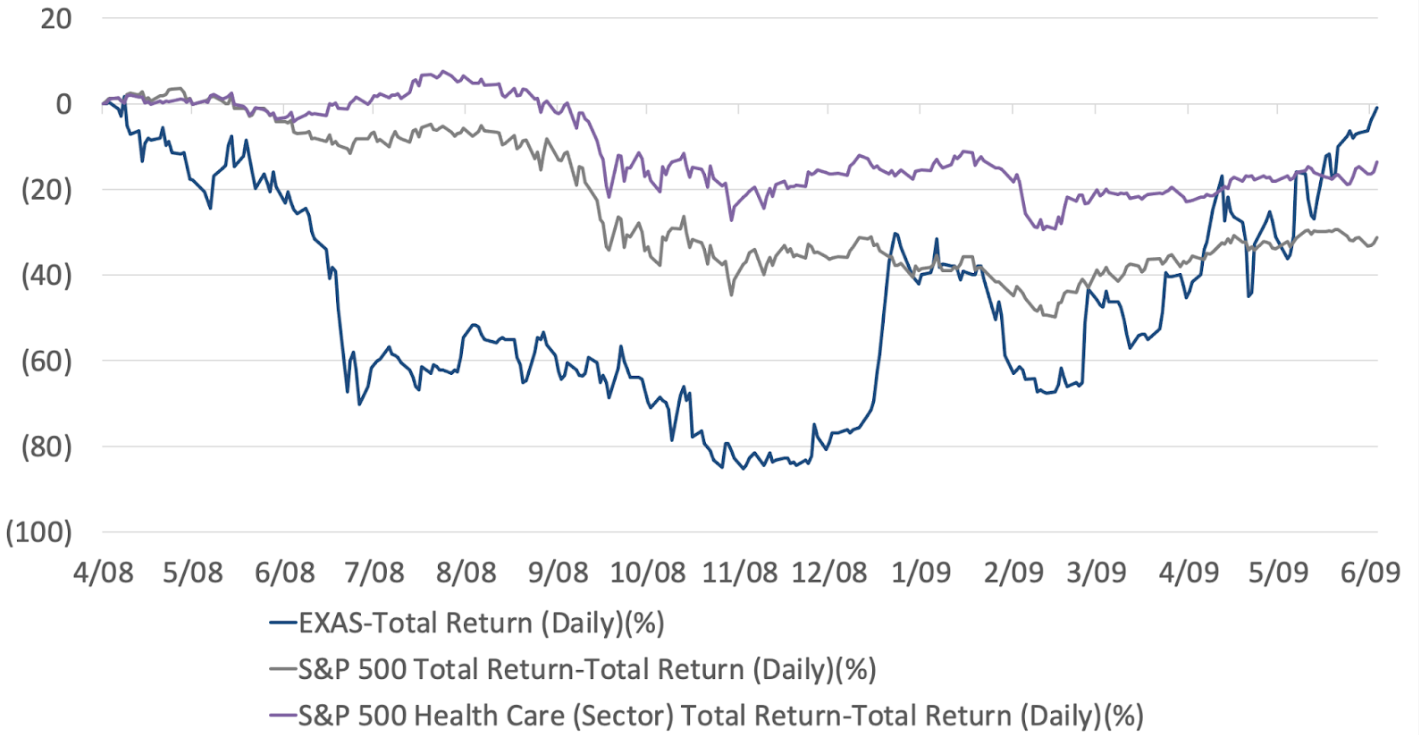

In 2009 Exact Sciences had a market cap of around $30 million, cash reserves of $21M (sufficient for 1.5 years), a promising business, and was delivering on its milestones. Nonetheless, the firm’s share price was down about 60% in the early half of 2009. The problem seems to have been that the firm was small (all small caps suffered) and that it was “shifting the paradigm” of colorectal cancer through early stage diagnostics – the market did not know how to value the IP.

Exact Sciences profile

- Pre-commercial company initially focused on “shifting the paradigm” of colorectal cancer through early stage diagnostics.

- Disruptive Innovation: Developed a discrete at home DNA test for colorectal cancer.

- Improved access to care: Instead of enduring a colonoscopy, patients could screen utilizing a simple at home test.

EXAS suffered large losses during 2008 and into 2009, but managed to bolster their balance sheet, execute on their IP, and to capitalize on the natural lift in the market after the great recession.

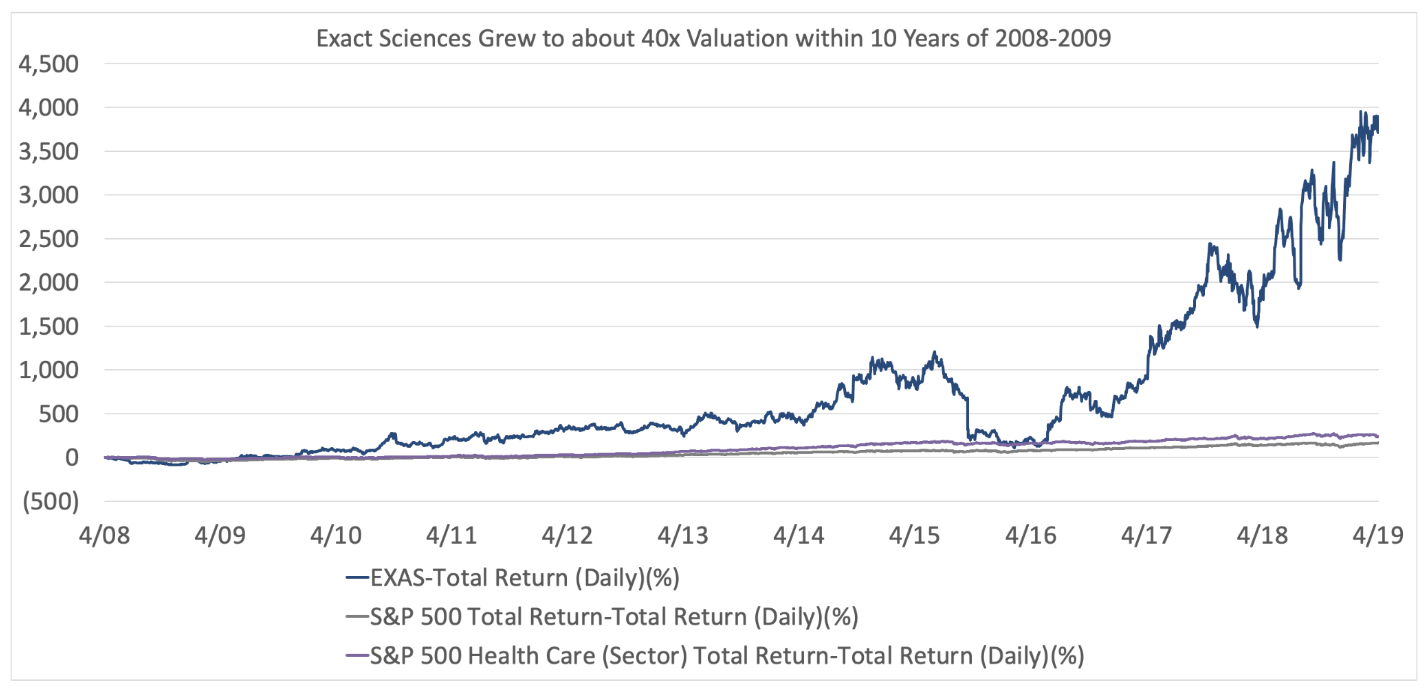

Eventually the discrete at-home DNA test for colorectal cancer the firm developed, Cologuard, won out, and became ubiquitous. The management team continued to execute, and the firm returned 300% in 5 years, and about 10x in 7 years.

Healthstream

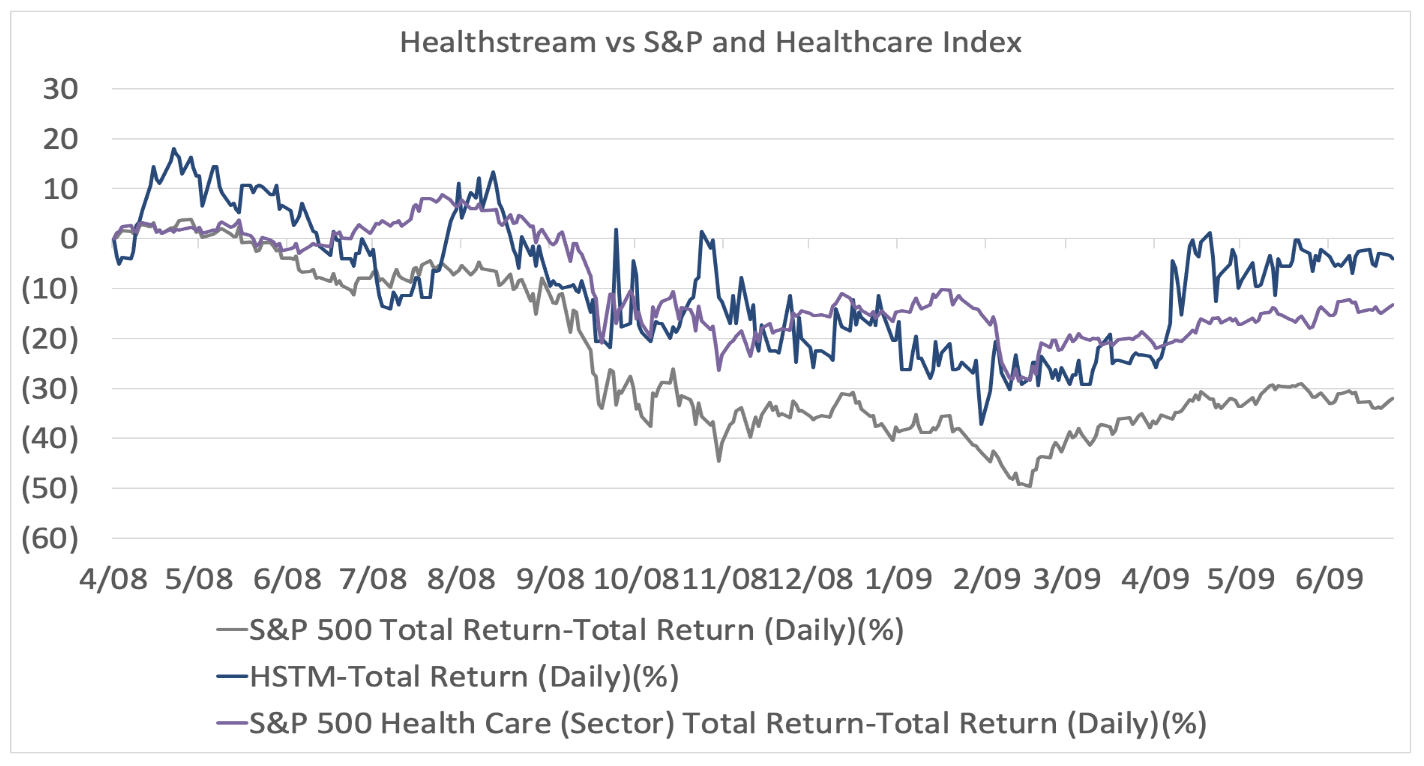

Healthstream was a well established small cap company at the onset of the Great Recession with year over year income growth and a disruptive business.

Healthstream Profile:

- Internet based learning platform for hospital staff

- Disruptive Innovation: easy-to-access training modules and classes (hospitals could move expensive in person classes online to meet credentialing requirements; pharma and med-tech companies could reach providers more easily; and providers could take training courses to treat their patients better)

- Improved access to care: Healthstream’s products removed friction in training staff enabling access to a greater number of providers and indirectly provided better patient care to areas of the country that may not have had access to training.

However, in spite of several strong catalysts the stock price continued to decline throughout 2008-2009.

Catalysts

- Revenue up 41% YoY in Q1, announced in April 2008

- Announced a stock repurchase program on 7/2008

- Renewal rates between 88-98%

- September 2008 announced launch of new training courseware platform

- October 2008 announced partnership with the largest provider of behavioral health and human services.

- February 2009 hit revenue guidance.

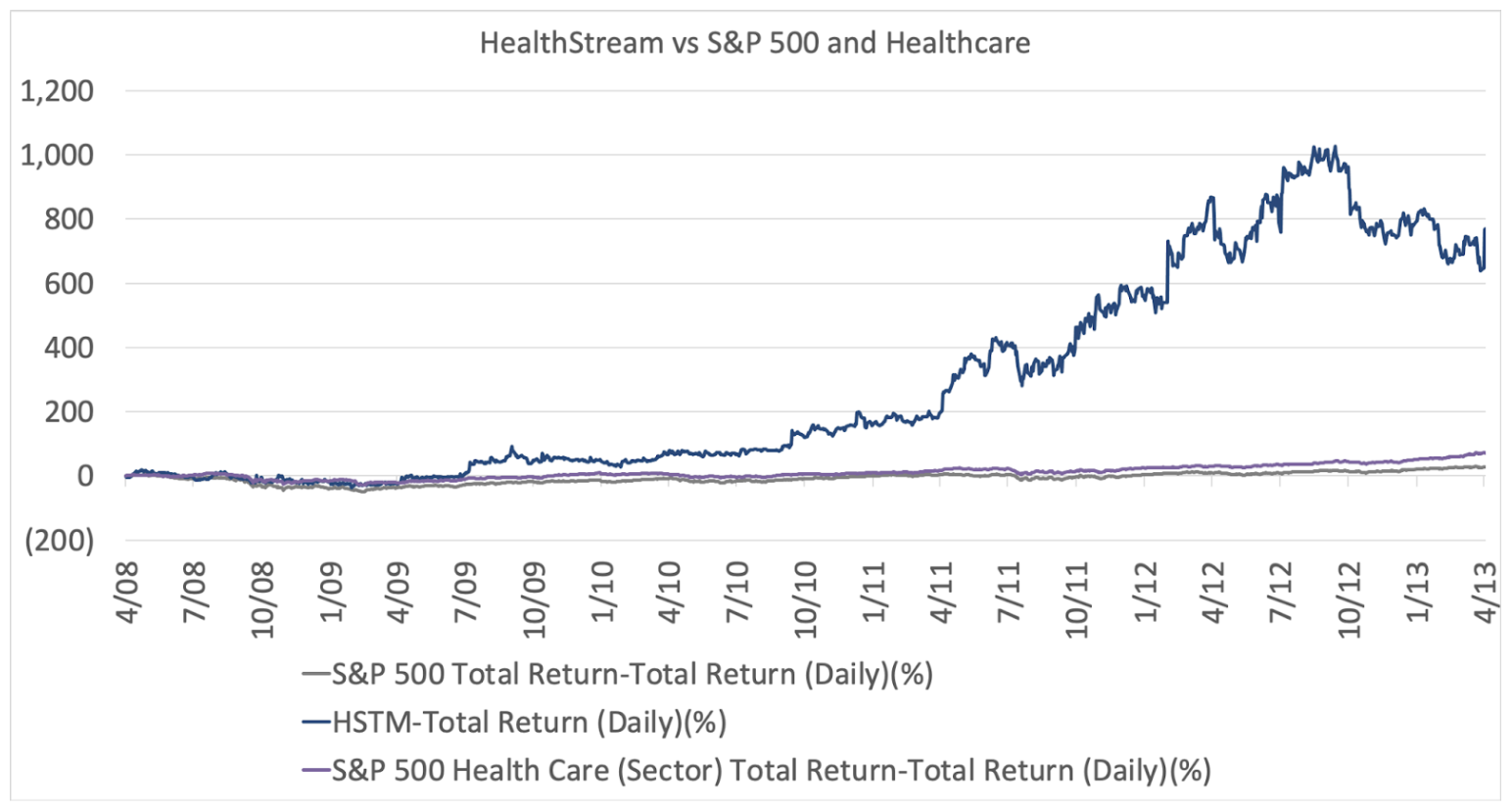

In spite of suffering losses throughout the year, Healthstream began to rally as the market returned. By October of 2010, the stock price doubled. It then grew to provide 10x returns in a little over 3 years, and eventually 12x in about 4 years.

There’s many more compelling and disruptive examples from the last large market downturn, but we wanted to highlight a couple that we would find interesting today. We recognize that our analysis, which goes broader than these names, had the benefit of hindsight, but it does not negate the usefulness of deciphering how the market has treated small healthcare companies, including promising ones, in the past. We look forward to doing a similar analysis on the performance of select companies at the end of the current downturn. Thank you for your time. Please reach out if you have any questions, or if you are interested in setting up a meeting with our team. Have a great rest of your week, The ST Global Health Team *Past results do not guarantee future performance*