ST Global Health Newsletter

Hi and welcome to the first installment of the ST Global Health Fund newsletter. Our goal in our semi-regular newsletters is to provide context and musings on the overall markets, the healthcare sector, small caps, and to highlight some interesting companies.

If you are interested in setting up a meeting with our team, do reach out. Needless to say, it has been a challenging year in both the public and private markets. A lack of clarity around rising interest rates, decreased multiples, M&A activity, and the Silicon Valley Bank failure have all contributed to a risk off environment and reduced liquidity. In our first newsletter, we wanted to compare the current time period to previous downturns to gain a better understanding of how various sectors rebounded when the market came back. While we will focus on the market dynamics of 2008-2009, we have seen similar patterns of outperformance when evaluating the market cycles of the last 50 years.

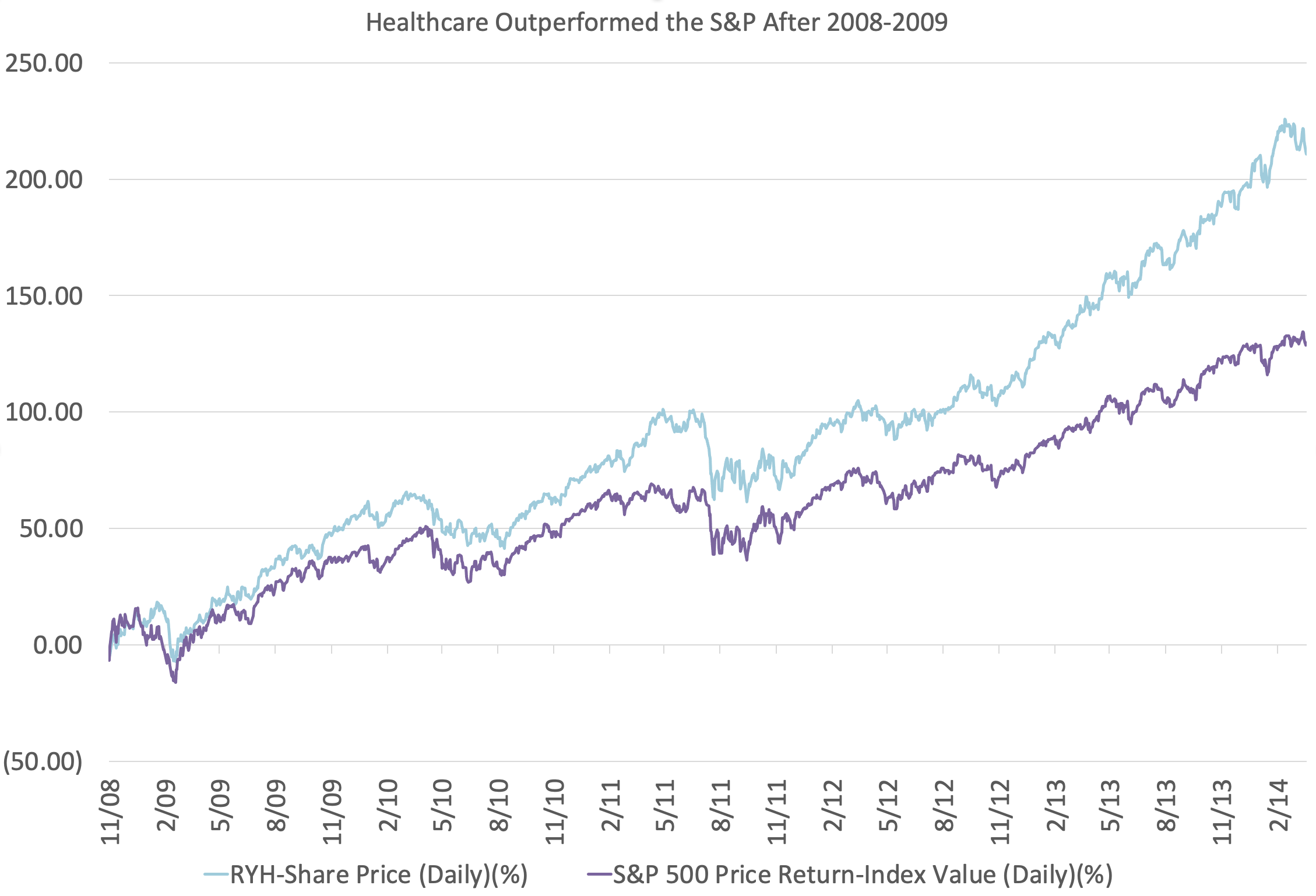

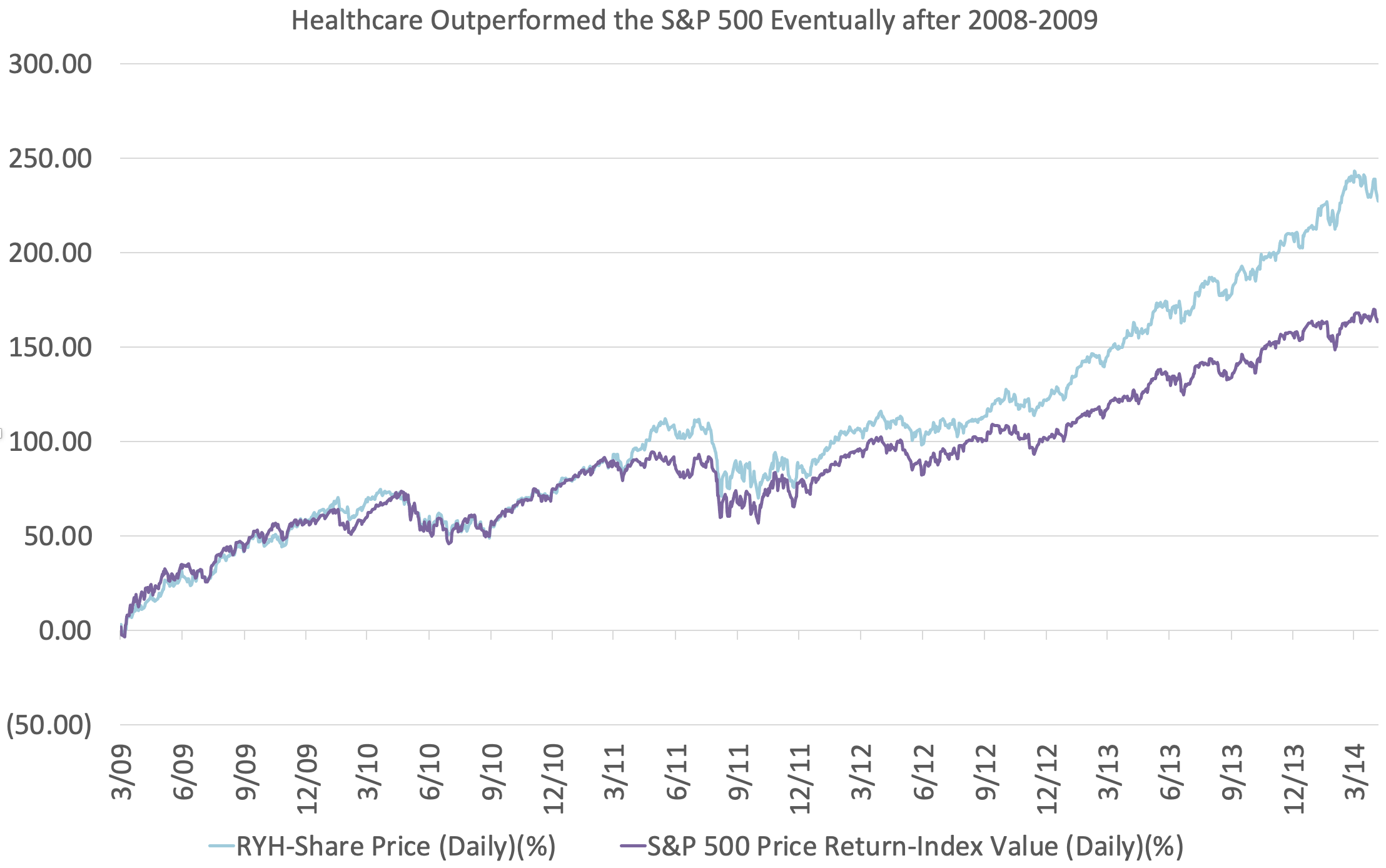

Healthcare Generally Outperforms the Market – But Timing Matters

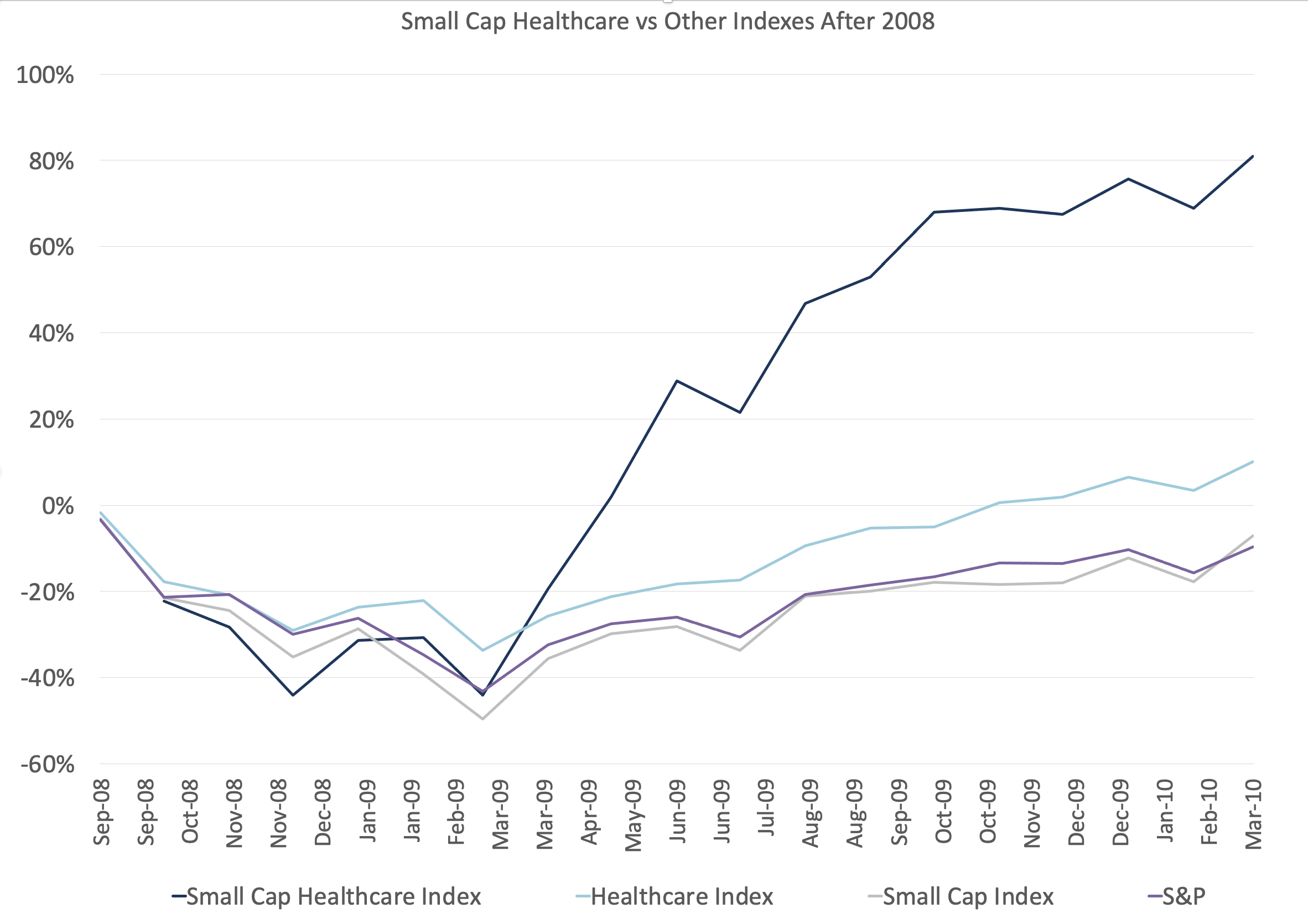

Healthcare has outperformed the general markets for a long time, and significantly outperformed the market after the 2008-2009 dip. The figure above shows market returns of healthcare vs the general market, as the financial crisis became apparent in late 2008.

However, it appears though that timing matters. If performance is measured from the lowest point in the general market, healthcare still outperforms, but it does so two years later. By waiting for the lowest price in the market in ’08-’09, healthcare investors may have avoided further losses in the short term, but would not have outperformed the S&P in the medium term.

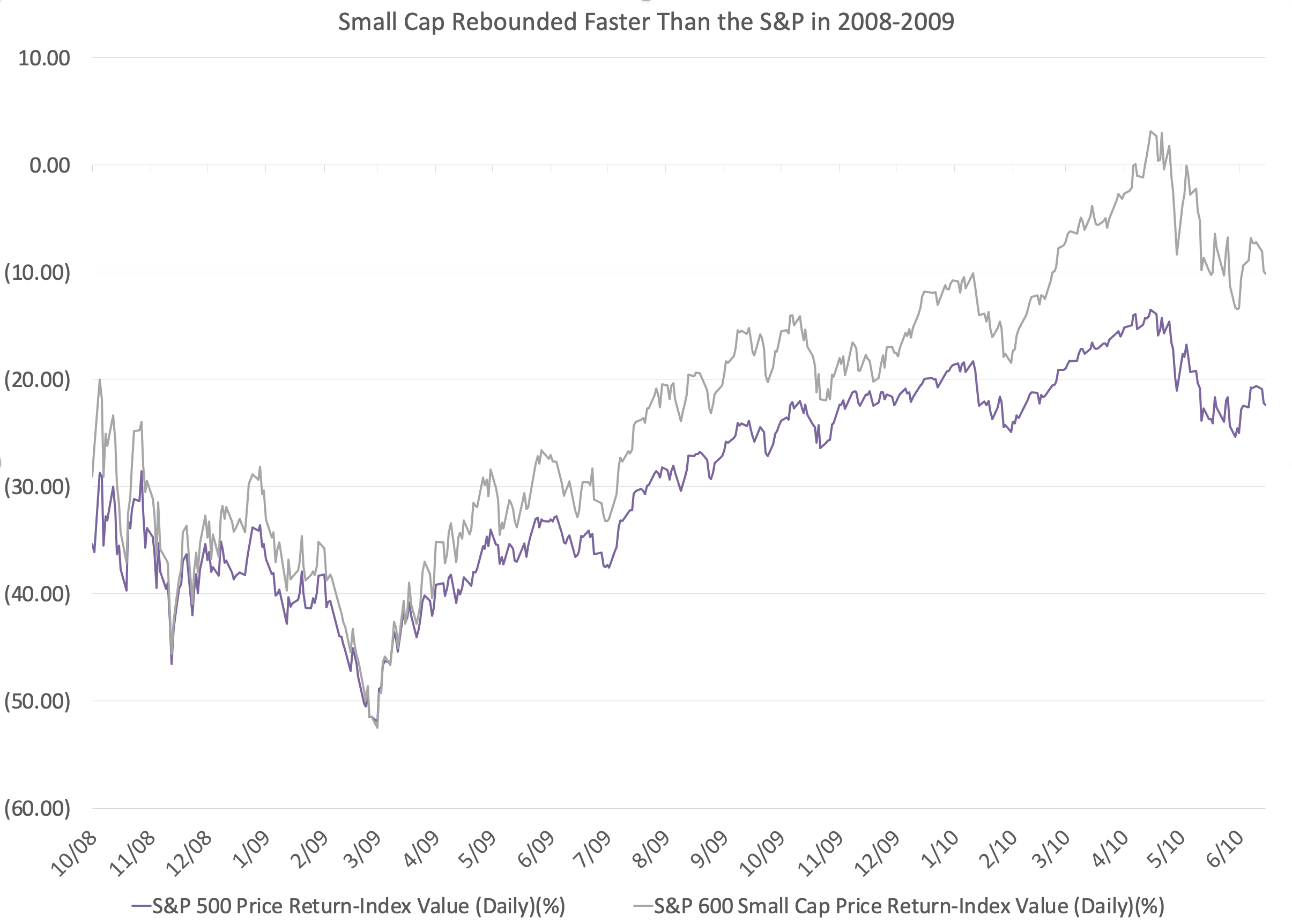

As expected, small cap firms suffered worse losses during the 2008-2009 recession initially. However, from the lows of early 2009, small cap companies began their divergence from the S&P almost immediately, outperforming the S&P by about 10% in about 3 months, and about 30% within a little over a year.

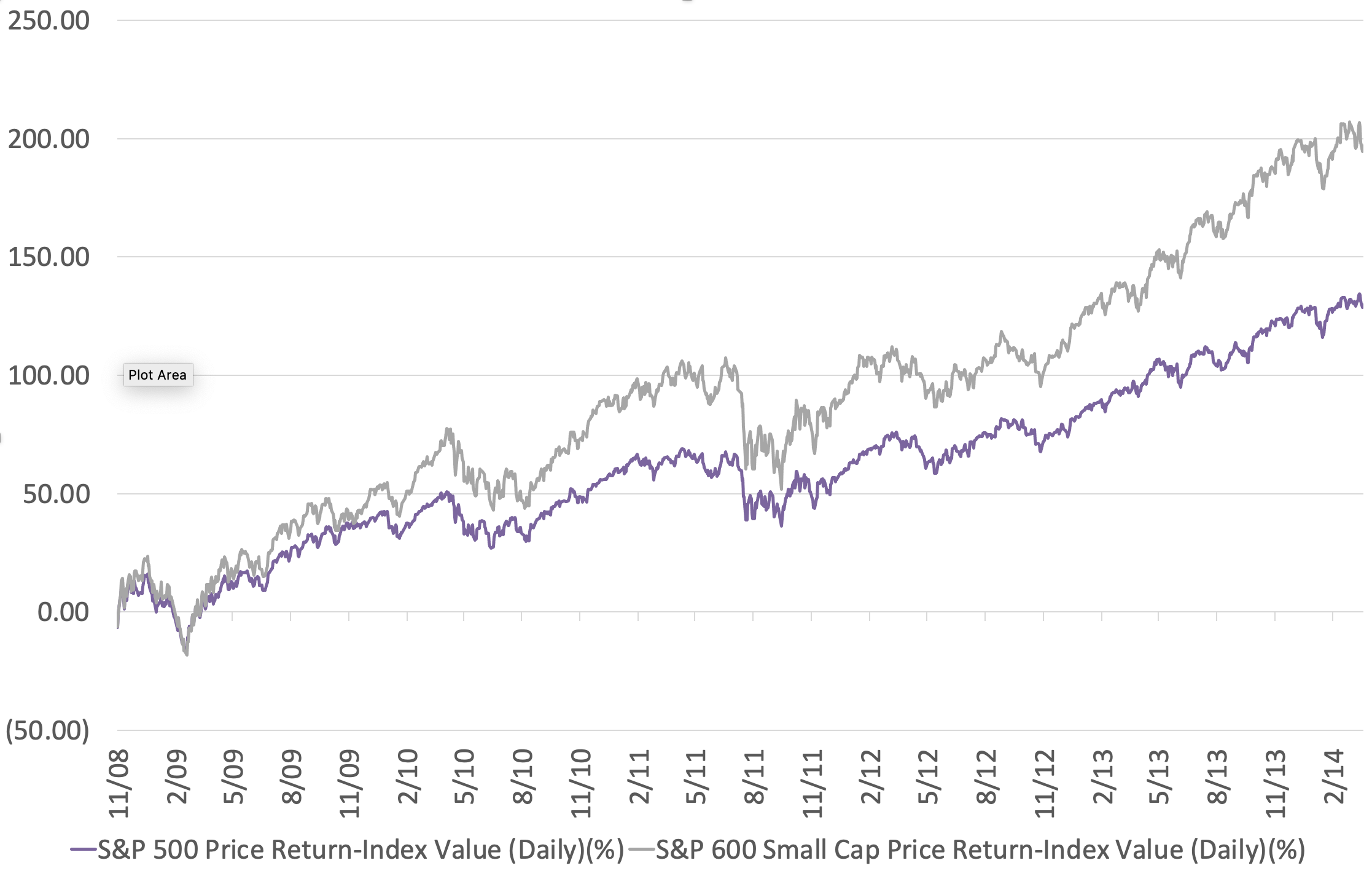

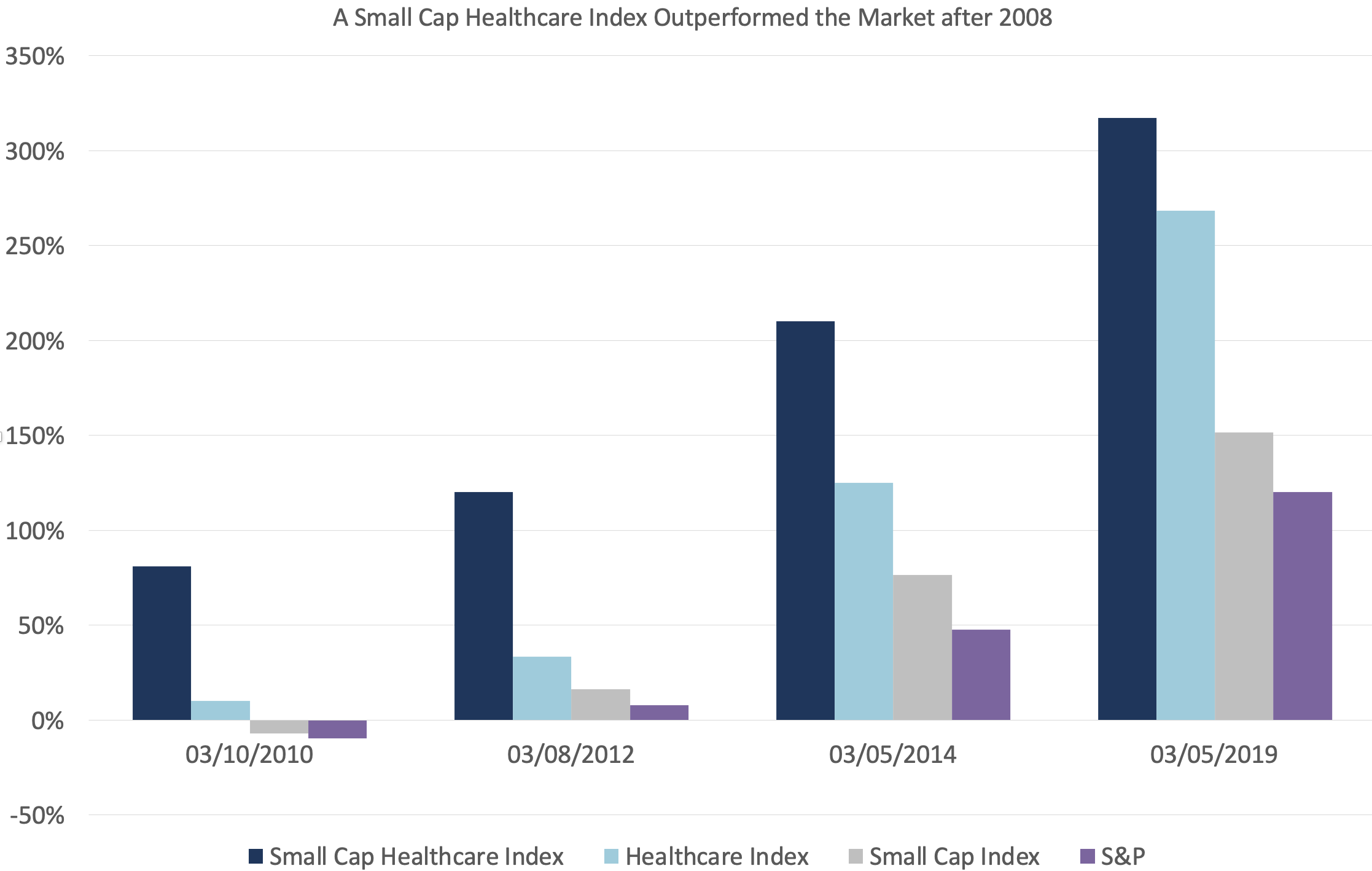

Based on the outperformance of both a healthcare index and a small cap index after the 2008-2009 recession, we were interested in evaluating how small cap healthcare companies performed in subsequent years. We thus created an index comprised of all NASDAQ and NYSE listed healthcare companies that traded below a $1.5B market cap and mapped their progress over the next years.

Small cap companies tend to outperform when the market rebounds. The figures above paint a clear picture of what happened in the last recovery – especially with healthcare stocks. While this analysis does not cover the complexities of our usual process, we are encouraged by the current point in the cycle – a view that seems quite different from most investors. While the year has been challenging in the markets, we find it is good to keep the medium and long term time frame in mind. Thank you for your time. Please reach out if you have any questions, or if you are interested in setting up a meeting with our team. Have a great rest of your week, The ST Global Health Team *Past results are not and should not be viewed as an indication of future results*